“Past performance is no guarantee of future results,” sounds familiar? You might have read this in every investment brochure in the form of a disclaimer mandated to be discussed by brokers and fund managers. This disclaimer is oftentimes ignored by investors. Let’s take the 2020 pandemic as a good example, before the lockdowns, stocks are at an all-time high but came crashing during the pandemic. In a volatile, uncertain, complex and ambiguous world we live today, this disclaimer remains valid.

Understanding electricity prices

Electricity is a commodity traded in the spot market and futures market. In the spot market, trades and delivery of electricity are immediate (5 minutes to an hour). While in the futures market, trades can happen now but delivery of electricity is on a specified date which can be a few months to 3 years ahead.

So retailers, when evaluating energy rate offers, look at the electricity futures curve – a projection or speculation of prices based on the retailers’ expected spot market price and the risk premium. This is in addition to your consumption patterns and volume, possible contract duration and location.

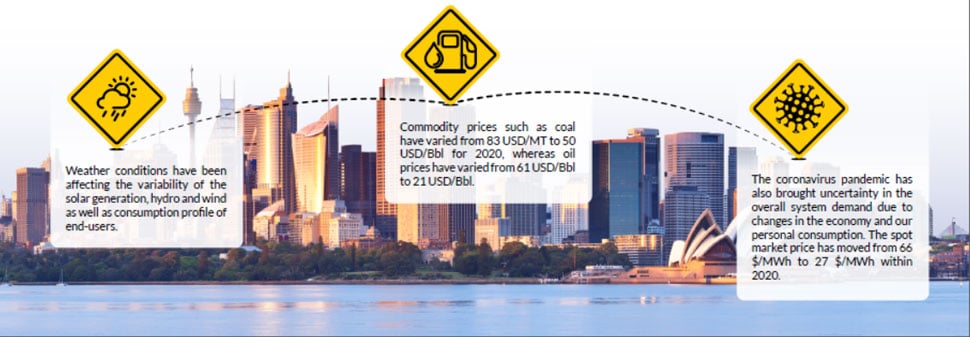

Electricity market prices are driven by several factors

|

|

Some of these factors, such as weather conditions, price of commodities, plant outages and consumption patterns are quite volatile and difficult to predict.

These factors, aside from contributing to the overall price volatility, drive a retailer’s expectation of spot market prices. And to include the risks brought by the uncertainty of future spot prices, retailers also factor-in a risk premium in your energy price. This brings your energy price higher than the expected futures price. The risk premium usually goes down as your contract start date is nearer. Why? Because the closer you are to the contract start date, the more certain you are about the information which can affect the prices.

Which is better, 1-year or 3-year contracts?

Some retailers claim that you can benefit from a 3-year contract versus purchasing energy contracts in a rolling annual basis with the intent of locking you in for a longer period of time. Long-term contract is usually advantageous for the retailers as it provides a guaranteed flow of revenue and a hedge against low spot market prices.

To illustrate, take this example:

While your energy price is relatively close to the actual spot market price during the 1st year, it went way above on the 2nd year. The spot market dipped as low as 2.73¢/kWh, driving the retailers to react and sell at relatively low rates at 4.40¢/kWh to customers (Point C).

Since you are locked-in during this low spot market period, you are not at liberty to grab this offer. If you had the chance to recontract this rate in 2020, you could have saved about 20% in your electricity bill. A sad reality for long-term contracts.

Now, let’s look at a 1-year contract using the same illustration above. Let’s assume in mid-2020, you went to market, taking advantage of the low spot market. Retailers are pricing their offers at 4.40¢/kWh for years 2021, 2022 and 2023. Instead of locking-in for 3 years, you opted for 1 year only. So, come 2021 and you have to renew again for 2022, the prices are now at around 5.50¢/kWh for the next 3 years. As you can see, if you had secured a longer contract back in 2020, you’d still be paying the cheaper 4.40¢/kWh in 2022.

From these examples, you see that there’s really no certain way to know if having a 1-year or 3-year contract is better than the other. Always keep in mind that there are factors at play when determining electricity prices.

Keeping an eye out

Again, look beyond past performances, a lot of factors are at play when it comes to electricity prices. Given the different factors, you may want to either lock-in prices for longer duration given a downward trend in prices or hold it off if there’s an upward trend in the market and renew with a shorter contract.

To get the best rates available, Power Choice can keep an eye out in the market for you! Whether a short or long-term contract, our Energy Experts know when’s the best time to go to market and obtain favourable rates that will help save your business more.

Speak to a Power Choice expert today!

Call us at 1300 165 020 or email [email protected].